Alpen Capital announced the publication of its GCC Retail Industry report. Detailing a comprehensive perspective on the retail industry, the report states major market characteristics and changing dynamics of the industry. The report examines the key sub-segments of the retail market by analyzing the fundamental growth drivers and significant challenges and developments. The comprehensive report also profiles some of the big names in the retail industry of countries in the region.

“The retail industry continues to maintain a positive momentum attributed to key factors influencing the market like robust economic growth, rising purchasing power, growing population comprising a large proportion of expatriates, changing consumption patterns and increasing penetration of international retail players. Retail structure in the GCC region is undergoing significant transformation, driven by the social and economic developments that has resulted in an increase in modern retail formats such as hypermarkets and supermarkets. The Gulf is also gearing to host events such as World Expo 2020 and FIFA 2022, leading to a growing influx of tourists and creating immense opportunities for existing and new retailers in the region,” says Sameena Ahmad, Managing Director, Alpen Capital.

“Socio-political stability coupled with the government initiatives directed at increasing economic diversification is creating a positive environment for investors in the GCC. The M&A activity in the sector has picked up pace in recent times. In recent years, several deals have taken place in the sector that involved some of the region’s leading retailers including the Savola Group, Damas International, LuLu Group and Al Meera Consumer Goods Co. Despite the challenges, the GCC Retail sector enjoys a favourable growth phase as it is placed on a sturdy foundation of robust economic growth, rising disposable incomes, a young and growing population base fascinated with brands and growing global recognition of Dubai as an attractive tourist destination.,” says Mahboob Murshed, Managing Director, Alpen Capital.

The Retail Industry Outlook

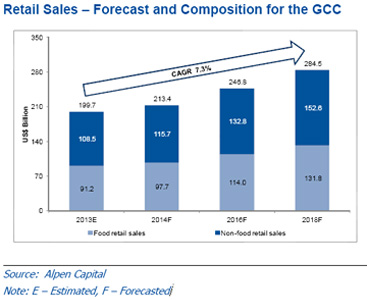

According to Alpen Capital, the GCC retail sales is expected to grow at a 7.3% CAGR between 2013 and 2018 to reach US$ 284.5 billion.

Food retail sales growth is anticipated to out-perform the non-food retail sales due to higher demand for healthier and high-value food in the region.

Sales of supermarket and hypermarkets in the GCC are expected to reach at US$ 59.3 billion, translating into a five-year CAGR of 9.2%. This growth is expected to be driven by increasing disposable incomes and modernization of the industry.

Airport-based duty free sales in the Middle East are estimated to increase from US$ 3.9 billion in 2013 to US$ 6.6 billion in 2018. This growth is expected to be driven by robust passenger traffic across all the leading airports in the region.

The personal luxury goods segment in the Middle East is expected to grow at a 4.6% CAGR between 2013 and 2018 to reach US$ 9.4 billion in sales.

Country wise Retail projection

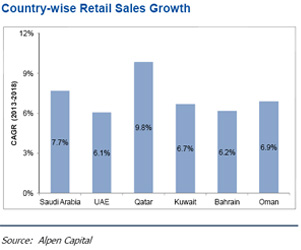

While retails sales growth across all the GCC countries is expected to remain positive between 2013 and 2018, the outlook for Qatar is most optimistic During the period, the Qatari retail market is expected to grow at a CAGR of 9.8%, when the remaining countries are seen registering an annual average growth rate of 6%-7%.

Based on the moderate growth scenario for our supply-side estimates, occupied modern retail sales area in the GCC is projected to reach 6.6 million square meters (sq m) in 2018 while expected growth in the supply of modern retail sales area over the forecast period is partially lower than the demand-side CAGR estimate for retail sales, the supply of new modern retail sales area is expected to adequately meet the increasing demand for retail space over the next five years.

Growth drivers

The population base of the GCC region is one of the fastest growing, with 41% of its population in the age group between 15 and 34 having a strong preference towards international brands. The region also has one of the most attractive corporate tax regimes which works as an attraction to retailers.

The population base of the GCC region is one of the fastest growing, with 41% of its population in the age group between 15 and 34 having a strong preference towards international brands. The region also has one of the most attractive corporate tax regimes which works as an attraction to retailers.

The region’s economy has emerged as one of the richest and fastest growing in the world, largely on the back of its proven crude oil reserves. The region is comparable to some of the strongest developed economies of the world, supported by its cash-rich governments, healthy credit ratings and strong currency reserves.

Dubai’s successful bid to host the World Expo 2020 paves the way for further growth of its non-oil sector, lending momentum to the construction, tourism and hospitality sectors. Qatar’s non-oil sector increased by more than 10% in 2014, stimulated by its major infrastructure projects such as the Doha Metro and the Hamad International Airport. Some countries in the region are however yet to reduce their dependence on the hydrocarbon sector to a meaningful degree.

Among other key driving factors of the industry are the increase of retail sales area, growing e-commerce segment, easy availability of credit and interest payment plans, increasing consumer confidence and government initiatives to promote infrastructure, hospitality and tourism sectors.

Trends

Changes in lifestyle and increasing health awareness among the young and working population is fueling the demand for healthier and convenience food options. Homegrown brands are also on a rise demonstrating a strong growth plan by expanding their footprint in the market and competing with international retailers by attempting to match their services and offerings.

The format of modern convenience store is also fast emerging as one of the highly promising segments of the retail industry in the region due to its innovative and customized offerings and ease of access. As well as the local malls trend is gaining traction in the GCC region due to the convenience of shopping and attractive promotion schemes they offer. From the retailers’ perspective, such malls help in growth of home brands and local small and medium enterprises.

Overall, the retail sector in the GCC region presents investors with good opportunities as the market is expanding and is expected to perform well in the future. All stakeholders are making concerted efforts to tap the potential, with the robust fundamentals of the region being a strong motivating factor.

Challenges

Although the industry is growing there are few factors that pose a threat or challenge to its growth.

The GCC is heavily dependent on the hydrocarbon sector thereby exposing it to risks arising out of oil price fluctuations. Despite the increase in total retail space and expected GLA supply in the coming years, retail rental rates in many Gulf cities have been on an upward trend. Such overhead escalations can have a negative bearing on retailers’ margins. A shortage of skilled local workforce increases the dependence of the industry on the expatriate staff.

E-commerce remains highly unexplored in this region due to inadequate online infrastructure and logistics. Rising competition among retailers, low penetration of credit card usage and parallel existence of a counterfeit product market are some of the other challenges.

Despite various challenges and change in trends, GCC’s retail sector is placed on a sturdy foundation of robust economic growth, rising disposable incomes, a young and growing population base fascinated with brands.

Please click here to access the GCC Retail Industry report online.

Back

Back