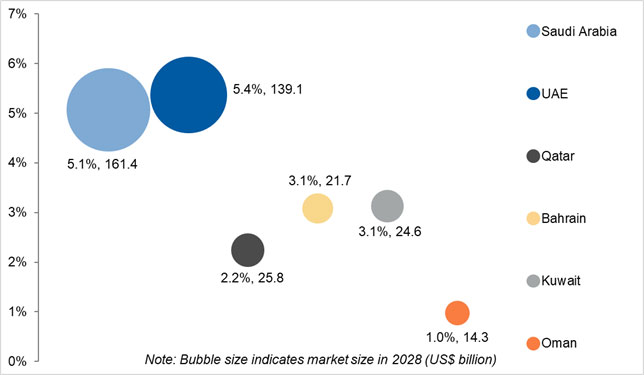

According to Alpen Capital’s report, retail sales in the GCC nations are projected to grow in the range of 1.0% and 5.4% CAGR between 2023 and 2028

The transformation of the GCC’s retail industry is being led by Saudi Arabia and the UAE. These two economies, driven by favorable demographics, strong consumer spending, and robust tourism sectors, are set to dominate the regional retail landscape. According to Alpen Capital’s report, retail sales in the GCC nations are projected to grow in the range of 1.0% and 5.4% CAGR between 2023 and 2028. Saudi Arabia and the UAE, in particular, are expected to lead retail sales, driven by their expanding population base, rising affluence, and world-class shopping infrastructure that attracts both residents and international tourists.

Favorable Demographics and Rising Spending Power

The GCC’s population grew at a CAGR of 1.5% between 2018 and 2023, reaching 57.1 million, and is projected to expand further at an annualized rate of 1.8% to over 62.5 million by 2028. Saudi Arabia and the UAE are key drivers of this trend, with Saudi Arabia’s population expected to grow at a CAGR of 2.0% and the UAE at 0.7% over the next five years. A significant proportion of the region’s population consists of expatriates (around 50% of the total population and over 75% of the private sector workforce), contributing to a strong consumer base that fuels retail expansion.

The GCC’s GDP per capita stood at US$ 70,339 in 2023, significantly higher than the global average

The region’s wealth also plays a crucial role in supporting high retail spending. The GCC’s GDP per capita stood at US$ 70,339 in 2023, significantly higher than the global average. The UAE, in particular, is witnessing growing consumer confidence, with 60% of residents expecting improvements in their finances compared to a global average of 37%. Additionally, 42% of UAE consumers expressed confidence in increasing their spending, nearly double the global average of 22%. This trend reflects a resilient and optimistic retail environment.

Saudi Arabi and UAE are expected to account for 77.7% of total GCC retail sales by 2028

Retail Market Outlook: Saudi Arabia and UAE Lead the Way

Retail sales in Saudi Arabia and the UAE are projected to grow at a CAGR of 5.1% and 5.4%, respectively, between 2023 and 2028, reaching US$ 161.4 billion and US$ 139.1 billion. Cumulatively, both nations are expected to account for 77.7% of total GCC retail sales by 2028, outpacing the GCC’s average retail growth rate of 4.6% CAGR over the period. Saudi Arabia is set to maintain its dominance with a 41.7% share in total retail sales through 2028, followed by the UAE at 36.0%, Qatar at 6.7%, and Kuwait at 6.4%.

Country-wise Retail Market Size and Growth for GCC (CAGR: 2023E – 2028F)

The UAE continues to lead the region’s MICE market, accounting for 50% of its total value. Saudi Arabia, on the other hand, is actively expanding its entertainment, cultural, and religious tourism offerings

Tourism and MICE Industry: Key Catalysts for Retail Expansion

Tourism remains a key pillar of economic diversification in the GCC, with Saudi Arabia and the UAE investing heavily in this sector. The UAE continues to lead the region’s Meetings, Incentives, Conferences, and Exhibitions (MICE) market, accounting for 50% of its total value. Saudi Arabia, on the other hand, is actively expanding its entertainment, cultural, and religious tourism offerings. The Kingdom topped UN Tourism’s ranking for international tourist arrivals growth in 2023, achieving a 56% increase compared to 2019 levels. As tourist arrivals surge, shopping malls, luxury brands, and retail outlets are poised to benefit, reinforcing Saudi Arabia and the UAE as premier global retail hubs.

The UAE’s upcoming mega-events and Qatar’s international sporting calendar will further enhance retail opportunities. Meanwhile, Saudi Arabia’s Vision 2030 aims to attract 150 million tourists annually, with a focus on religious tourism. The recent relaxation of Umrah visa policies is expected to increase footfall in Makkah and Madinah, boosting demand for retail, hospitality, and food services.

E-commerce: A Driving Force in Retail Transformation

The GCC’s tech-savvy millennial population is rapidly transforming the retail landscape, with a growing preference for e-commerce. The UAE and Saudi Arabia have witnessed an influx of online platforms such as Noon, Ounass, and Amazon (Souq). FinTech players like Tamara, which secured US$ 150 million in funding, are enhancing the region’s digital payments ecosystem, further supporting e-commerce growth. As traditional retailers integrate omnichannel strategies, Saudi Arabia and the UAE are emerging as innovation hubs for retail in the digital age.

Saudi Arabia and the UAE are shaping the future of retail in the GCC, backed by strong demographic trends, a robust tourism sector, and increasing e-commerce penetration

Saudi Arabia and the UAE are shaping the future of retail in the GCC, backed by strong demographic trends, a robust tourism sector, and increasing e-commerce penetration. With retail sales set to exceed US$ 300 billion by 2028, both countries are well-positioned to attract global investments and maintain their status as premier shopping destinations. As Alpen Capital’s report highlights, the region’s retail market remains resilient, offering significant opportunities for growth and innovation in the years ahead.

5 min

5 min