Food consumption in the GCC is projected to grow, driven by demographic expansion, rising spending power, and burgeoning tourism. National strategies and shifting dietary preferences toward health-conscious alternatives are reshaping the sector. Rising demand for healthier, fresh, and nutrient-rich foods — including organic and clean-label options — is spurring investment and innovation. In response, regional players are boosting local production, expanding capabilities, and enhancing competitiveness.

Alpen Capital’s comprehensive industry research reports on the food sector feature forecasts on the consumption patterns of the six GCC nations across major food categories, along with in-depth analysis on recent trends, growth drivers and challenges facing the segment. Furthermore, the report also profiles some of the food companies in the region.

Featured Report

GCC Food Industry Report

According to Alpen Capital, food consumption in the GCC is projected to grow at a CAGR of 1.7% to reach 55.5 million MT by 2029 from an estimated 50.9 million MT in 2024. This growth is expected to be driven by an increasing population, high per capita incomes and rising tourism. Additionally, the heavy investments being made by the regional governments to strengthen food security is likely to support a sustainable supply of food items to meet the rising demand.

The country-wise food consumption share in the GCC is projected to change marginally through 2029. Saudi Arabia and the UAE are expected to remain the largest food-consuming nations, and their combined share of total GCC food consumption is forecasted to reach 73.8% by 2029. Oman is set to witness the highest CAGR at 3.8%, followed by Bahrain with a CAGR of 3.3% during the forecast period. The remaining GCC countries are expected to register growth rates between 0.1% and 1.8%.

Download Report

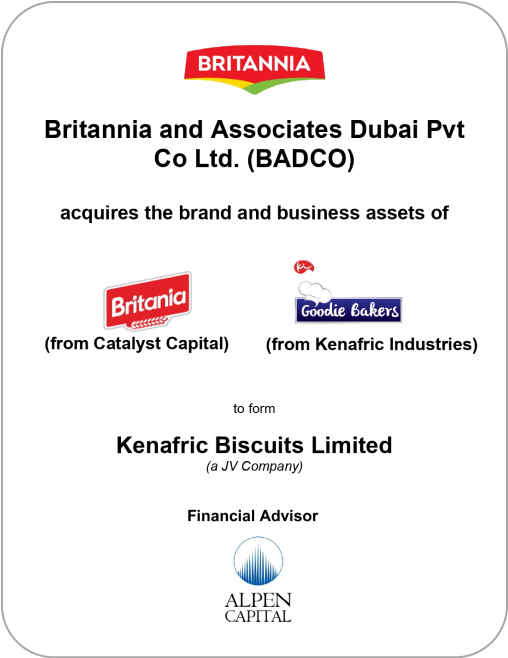

Select Transactions

Browse Latest Articles

Let's Connect

Alpen Capital's team brings decades of experience in advising companies in the food sector on cross-border and intra-regional acquisitions as companies focus on strengthening their position and expanding their portfolio, both domestically and internationally.