Alpen Capital forecasts a period of steady growth for the GCC Retail industry

Dubai, 4th December, 2012

Alpen Capital announced the publication of its Retail Industry report which provides a perspective of the overall industry, major market characteristics, and future trends. By examining fundamental growth drivers, significant challenges and recent developments, it presents an outlook for the GCC’s retail industry based on demand-side and supply-side approaches.

"Retail industry, which is one of the fastest growing sectors in the GCC, has thrived over the last several years due to increasing purchasing power, growing expatriate population, changing lifestyle and an expanding tourism & hospitality industry. Retailers have benefited from the government initiatives and progressive policy agenda and have a healthy period of growth ahead of them", says Sameena Ahmad, Managing Director at Alpen Capital

"The region’s retail sector has displayed strong resilience in the face of global economic downturn and is expected to continue to grow at a steady pace given its attractiveness to tourists and residents in terms of geographic location, developed logistics and availability of diverse and quality shopping options. While the sector presents attractive opportunities, it is highly competitive and retailers need to continue to innovate so that they can achieve sustainable growth and profitability", says Mahboob Murshed, Managing Director, Alpen Capital

The GCC Retail Industry Outlook

Demand side estimates

According to Alpen Capital, between 2011 and 2016, the GCC’s retail sales are expected to grow at a CAGR of 7.7% to reach US$ 270.3 billion by the end of the forecast period.

Food retail sales are anticipated to expand at a CAGR of 8.8% during this period while non-food retail sales are likely to grow at an annual average growth rate of 6.6%. Food sales growth will outperform non-food sales growth during the forecast period as high-value and healthier food products could find greater demand.

Sales of supermarkets and hypermarkets in the GCC are expected to grow at an annual average rate of 10.5% between 2011 and 2016. The relatively under-penetrated markets in terms of modern grocery retail formats like Saudi Arabia, Qatar and Kuwait are likely to outperform in this segment.

Duty free and travel retail sales in the Middle East are forecasted to grow at a CAGR of 11.6% from 2011 to 2016, outperforming the broader retail industry in terms of growth. The growth projection has been revised upwards from the previous report primarily in anticipation of higher passenger traffic at the Abu Dhabi and Qatar airports and concourse 3 plans at the Dubai Airport.

The outlook for the luxury segment remains positive and the luxury retail sales is expected to grow at a CAGR of 8.2% between 2011 and 2016.

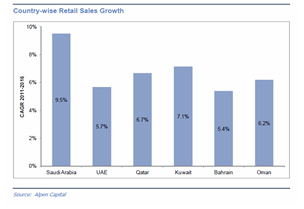

Country wise Retail projection

While retail sales in all the countries across the GCC region is expected to register positive growth through 2016, the outlook for Saudi Arabia is the most optimistic .The retail industry in Saudi Arabia is projected to expand at a CAGR of 9.5% between 2011 and 2016. All the other GCC nations are likely to register retail sales growth of around 5%-7% during the same period.

Supply side estimates

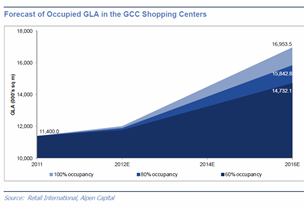

Based on a Moderate Growth scenario calculated at 80% occupancy over the next five years for the supply-side estimates, occupied gross leasable area (GLA) in the GCC is projected to reach 15.8 million sq m in 2016 compared to 11.4 million sq m in 2011 growing at a CAGR of 6.8% during the same period. Retailers are expected to continue their focus on improving efficiencies and making optimum utilization of retail space. Although the projected GLA additions in the GCC are unlikely to create an over-supply situation and vacancy rates are expected to remain under control, retailers may be selective in picking the right space for their stores in shopping malls. While supply of new GLA will be sufficient to meet demand for retail space over the next five years, it is reasonable to expect that a part of new additions may witness lower initial occupancy rates.

Growth Drivers

There are several factors contributing to the growth of the GCC retail sector. A consistently expanding population base, young population and growing urbanization make demographics of the GCC highly attractive for retailers of both essential and discretionary products. The region’s population growth rate has accelerated over the last three years, and is expected to sustain the pace going forward.

A growing GDP, substantial government spending on infrastructure and healthcare, low fuel prices and low or no tax incidence, free up a substantial portion of individuals’ income for consumption of food and non-food items and fuelled the growth of the retail industry. GDP per capita (PPP) of all the GCC economies is high and is expected to see a healthy growth.

Continued influx of tourists continues to be a key driver for the region’s retail industry. Going forward, international tourist arrivals in the GCC are forecast to grow from 37.3 million in 2011 to 44.4 million in 2016, registering a CAGR of 3.5% In line with the continued uptrend in tourist traffic, all the GCC countries have embarked upon ambitious plans to improve and expand their existing airport and airline infrastructure. An expanding tourism sector coupled with the establishment of the necessary infrastructure to handle this growth bodes well for the region’s retail industry, due to the close inter-relationships between the industries.

Online retail is increasing in popularity among consumers and retailers. Retailers also find this medium attractive as it reduces overheads and enables them to offer products at competitive prices. Growth in the online retail segment is supported by a growing number of internet users in the GCC.

Other key driving factors include the lengthy pipeline of modern and sophisticated malls which are now replacing the traditional souks and standalone stores, availability of strong and experienced franchise partners, strong consumer confidence and proactive measures taken by governments to pre-empt any form of social unrest.

Trends

One of the clear trends that is emerging in the region is the inroads by large supermarkets/hypermarkets in the GCC into private label retailing as they focus on profit growth. Currently, sales from private labels account for around 10% of overall retail sales, compared to just 3% three years back.

The concept of group-buying is becoming increasingly popular in the GCC, and is a major force behind the growth of online retail sales in the region. A number of online start-ups are benefitting from this trend. The development of advanced online platforms has made online shopping a highly convenient experience and shoppers are also enticed by the attractive deals offered by these websites.

Economic slowdown and high levels of personal debt have made an average consumer in the region to become more value conscious. The increasing price consciousness of consumers in the region can be gauged from the growing trend in favor of value retailers establishing their presence in the region.

The conventional franchise arrangement is now evolving further to develop a new model called sub-franchising. Though still nascent in the Gulf, the sub-franchise model may gain prominence as all concerned parties realize its benefits.

Challenges

Given that the region’s retail industry thrives, to a significant extent, on the favorable spending habits of its inhabitants and a booming tourism industry, socio-political stability is a very important factor for the sector. Recent events show that certain parts of the GCC are vulnerable to incidences such as the socio-political unrest and the global financial crisis. While the governments in their respective countries have taken the necessary remedial steps, socio-political stability is a very important challenge facing the sector.

Retails rentals have started to move up in top-tier malls in the GCC. As the global economic uncertainty gradually recedes, rental expenses are expected to increase further and squeeze margins of retailers. Containing inflation also remains one of the biggest fiscal challenges in the Gulf.

The retail industry is also highly dependent on the expatriate workforce. High attrition levels in the expatriate workforce and unemployment levels among locals continue to pose a human resource challenge for the retail industry.

Food retail sales represent a significant portion of the overall retail industry in the GCC. Disturbances in food supply will have a direct impact on retail sales in the region.

The retail space is highly competitive and retailers need to continuously re-invent themselves to drive footfall and attract patrons to gain market share. The sector presents attractive growth opportunities but in order to capitalize on them retailers need to constantly look at managing their businesses efficiently and find ways to innovate.

Please click here to access the GCC Retail Industry report online.

Back

Back