GCC Education sector undergoing an exciting phase of growth, says Alpen Capital’s latest report

All GCC locations, 2nd July, 2014

Alpen Capital today announced the publication of its GCC Education Industry Report which presents the growth prospects of the GCC education sector, based on the current developments within the sector, key market dynamics, and the existing investment opportunities in the region. The scope of the report encompasses the pre-primary, primary, secondary, tertiary, and vocational training segments across all GCC nations. Further, the report profiles the six GCC countries as well as some noteworthy private educational institutions in the sector.

"The growth of the GCC education sector is driven by factors such as population growth, increasing number of expatriates, the rising importance of high-quality education in the society, and a growing spending propensity. The sector is gaining additional momentum from governments across the GCC that are acknowledging the need for an education system capable of producing industry-ready graduates. Thus, with increased focus on improving the quality and reach of education in the region, the sector presents an interesting investment opportunity",says Sameena Ahmad, Managing Director, Alpen Capital

"The Education sector in the region is growing at a fast pace and presents opportunities for private investors. The M&A activity in the sector has picked up pace in recent times. Private players, both local and international, are attracted to segments such as the K-12 and higher education, which are the largest within the sector. Further, the new and promising industry-specific, niche sectors such as vocational training, finishing schools, child-skill enhancement, and e-learning are also receiving investor attention due to their growing demand",says Mahboob Murshed, Managing Director, Alpen Capital

The GCC Education Industry Outlook

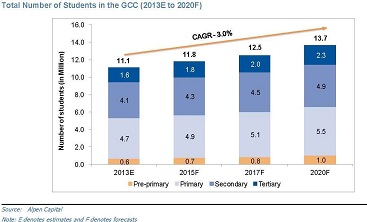

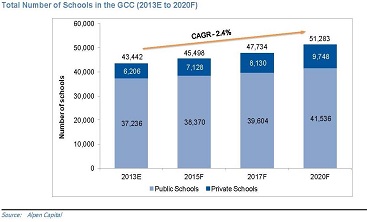

According to Alpen Capital, the total number of students in the GCC region is expected to grow at a 3% CAGR between 2013 and 2020 to reach 13.7 million. The total number of schools is expected to rise at a 2.4% CAGR from 2013 to 2020, concurrent with the increasing number of students in the GCC.

Enrolment increase at private schools is expected at a 6.7% CAGR between 2013 and 2020, due to the quality of education they offer and the favorable demographics in the region. The contribution of the pre-primary segment to the total enrolments in the industry is expected to increase from 5.8% in 2013 to 7.4% in 2020. Also, the tertiary segment is likely to see a surge in its share of the total enrolments from 14.8% in 2013 to 16.5% in 2020. The primary and secondary segments are anticipated to drop their share to 76.0% in 2020 from 79.4% in 2013.

The UAE is the most developed education market in the region and is an emerging education hub. The Saudi Arabian market is the largest, accounting for more than 75% of the gross enrolment within the GCC. Both the nations account for relatively mature K-12 and tertiary education segments. Following these leaders are the Qatari and the Omani markets, which are growing, with support from planned education reforms. The education markets of Kuwait and Bahrain are growing at a modest pace.

Key growth drivers

By the end of 2014, the GCC population is expected to reach 50 million. The GCC region thus harbours a favourable combination of a rising population base and increasing number of expatriates in the region that is expected to result in an increase in the demand for education.

Based on purchasing power parity (PPP), the GDP per capita across the region is expected to rise at a 3.1% CAGR between 2012 and 2019. With rising GDP levels, the disposable income of the middle-class across the GCC is expected to surge, presenting the prospect of this segment of the society turning to the expensive, high-quality education of private schools. Enrolments at private institutions in the UAE accounted for 69% of the total enrolments in 2012, up from 39% in 2000. Higher enrolments at private institutions through the last decade indicate their rising popularity.

Governments are focusing on enhancing the quality and reach of education across the GCC. The member nations are acknowledging the importance of private participation in accomplishing their objectives for the education sector. The result has been an increasing number of private schools and colleges being set up in the region. On an average, the GCC region is expected to experience a recurring spend of about US$150 billion on its education sector in the next couple of years.The GCC Education market thus presents opportunities for new private players and consolidation opportunities for the existing ones.

Industry trends

Rising demand for international schools: Private schools offering international curriculum are emerging as a preferred choice over public schools, with increasing number of students shifting from the latter to the former. A growing expatriate base has been spurring the setting up of private schools in the region. Sensing the potential, several international schools are setting up their branches or are entering into affiliations with the existing private institutions in the region. Private institutes across the GCC are also attracting students from the Middle East and North Africa (MENA) region, who seek quality education within a geographically proximate area.

Demand for Technology driven education: In order to enhance the global competitiveness of their education systems, governments across the region are focused on the incorporation of Information, Communication & Technology (ICT) into teachers’ professional development and their resultant use for classroom instruction. In particular, the development of high-achieving “smart” schools, based on the Singaporean and Malaysian models, is a rapidly growing phenomenon in the GCC countries.

Universities adapting to labour requirements: A demand-supply gap has surfaced in the labor market in the region. Due to increased job security and retirement benefits the locals turn to the government sector and it is forecasted that this will result in an over-crowded job market in the public sector with rising local population. As a result, governments are encouraging the youth to undergo technical and vocational training to enhance their employability in the private sector. This has created the need for quality higher education in the Gulf.

Emerging education hubs in the Middle East: The UAE and Qatar rank high as preferred education destinations by students in the Middle East. Factors such as simple visa procedures and the presence of international education institutes of repute are furthering the appeal of these two nations among students overseas. Students in the region are increasingly turning to Dubai, instead of the UK, to obtain quality international-level education. According to the UNESCO, Dubai has become the third most popular destination, following France and the US, among students from the Middle East.

Increasing female participation: Over time, the female population has been contributing significantly towards the growth of the higher education segment in the GCC. At 60% enrolment in tertiary segment in 2012, females represent the majority of the total higher education students in the region.

Challenges

Although the sector is geared to grow and presents excellent opportunities to investors, it still faces some challenges.

There needs to be a better alignment between the courses offered at education institutions to the industry requirements. This leads to increased demand in skill intensive areas such as engineering as most students across the GCC prefer subjects such as the social sciences and arts. Increased attention also needs to be given towards research and innovation at education institutions. The preliminary education segments across the GCC are still struggling to become the robust foundation that can prepare students for higher education.

The GCC also faces a shortage of skilled staff, primarily teachers, affecting the quality of education at both private and public institutions. A regulated fees environment also poses challenges in meeting the competitive compensation levels expected by quality teachers.

Setting up of a private school in the region is capital intensive, due to rising real estate prices, electricity expenses, licensing costs, salaries, and visa expenses. Additional education projects involve a long gestation period. Regulations such as cap on the fee structure also make it challenging for investors to evaluate the investment opportunity.

Despite these challenges, the GCC Education sector is on a growth path with the governments opening up the sector for private players, leading to increased private participation.

New and promising industry-specific sectors such as vocational training, finishing schools, child-skill enhancement, and e-learning are emerging in the GCC education sector. Investments are required in developing new-generation schools that cater to a wide-ranging diversity of the educational needs of the local population.

The special needs education segment also presents significant untapped opportunities, which extend to the areas of production and provision of diagnostic services to schools and individuals. Considering the present state of the special needs education segment in the region, the private sector can play a key role in enhancing the quality of special needs learning.

For more details please click here to access the GCC Education Industry Report online.

Back

Back