Alpen Capital today announced the publication of its GCC Hospitality Industry report. The report focuses on the key performance indicators of the GCC region’s hospitality industry, such as number of hotel rooms, ADR (average daily rate), occupancy rates, RevPAR (revenue per available room), growth rates, and the industry outlook over the next five years. The report evaluates the current demand and supply situation, growth dynamics, future prospects as well as the challenges faced by the GCC hospitality industry.

"The GCC economies are well on their way to recovery from the global economic crisis. With the recent wins in mega events like the Qatar FIFA World Cup 2022 and the Dubai World Expo 2020, the region is gearing up for an increase in tourist arrivals. Due to the forecasted increase in demand, the sector is going through capacity expansion as well as increasing investment into infrastructure. The industry is expected to sustain this growth momentum supported by the regional governments’ initiatives to grow the sector, international tourist arrivals, especially those from the Asian region, and growth in the MICE segment among other factors", says Sameena Ahmad, Managing Director, Alpen Capital

"The focus of GCC economies on education, healthcare, MICE activities supported by the aviation sector, have fueled the growth of the dynamic Hospitality sector. The sector will continue to grow driven by factors such as the shift in global activity from the West to the East, increase in leisure travel, growing demand for serviced apartments, shift towards budget travel and quicker construction pipeline. Given positive growth trends as reflected across occupancy levels, revenue and EBITDA margins, valuations remain attractive and hence, we expect activities across M&A and private equity funding to accelerate. The industry does face some key challenges which include, maintaining demand beyond the planned mega events, competing with newer projects/ concepts and attracting skilled labour to the region. However, we feel that the growth of the sector will be driven by supportive policy initiatives undertaken by GCC governments to enhance infrastructure; thereby positively impacting the continued investor appetite for the region and tourism", says Sanjay Bhatia, Managing Director, Alpen Capital

Industry Outlook

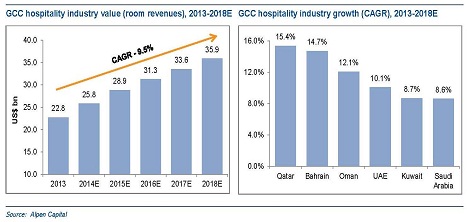

The GCC hospitality industry is expected to grow at an annual rate of 9.5% to US$ 35.9 billion by 2018 compared to the US$ 22.8 billion in 2013. Average occupancy rates are likely to be in the range of 68% and 74% between 2013 and 2018 while ADR is likely to average between US$ 225 and US$ 263 during the same period.

Saudi Arabia is expected to continue its dominance as the largest market in terms of revenues, followed by the UAE. Upcoming mega events in Qatar and UAE are expected to be the key growth drivers for the hospitality industry in these countries.

Growth drivers

The resource-rich GCC region’s growth prospects remain favorable, supported by stable oil prices and continuous government spending, especially on infrastructure upgrade and economic diversification. GCC countries continue to maintain a pro-business environment with no or low corporate taxes, which has encouraged private sector investments including foreign investments.

GCC is set to host mega events such as 2020 World Expo in Dubai and 2022 FIFA World Cup in Qatar. These coupled with high-profile annual events such as Grand Prix in the UAE and Bahrain are expected to draw a large number of visitors.

With state-of-the-art infrastructure facilities, the MICE (Meeting, Incentives, Conferences and Exhibitions) segment has expanded significantly in the recent past. The number of international association meetings in the Middle East has more than tripled in the last 10 years.

Governments across GCC region are investing billions of dollars to enhance tourism related infrastructure. In addition, for promoting tourism in the region as a whole, GCC countries are planning to introduce a unified visa that would allow tourists to use the visa issued by one GCC nation to visit all the others, just as a Schengen visa works for most of the European countries.

GCC region’s strategic location with respect to global air routes is driving the footfall of short-stay passengers. The region has effectively leveraged this opportunity with increasing investment in airports expansion. GCC airports are expected to handle about 250 million passengers by 2020 - according to a study published for the Airport Show, 2013.

Large number of foreign travelers, especially those from Asian region, continues to visit GCC countries. Asia has emerged as one of the biggest and fastest growing international tourist markets for GCC nations.

Trends

Shift in global activity from West to East: While the Western economies are struggling to recover from global slowdown, emerging Asian economies are witnessing healthy growth. GCC countries’ economic prospects will remain closely linked to growth in Asia as increasing energy demand from this region will help the GCC countries maintain a robust economic growth.

Increase in leisure travel: Leisure travel in the region is picking up momentum. UAE with US$ 23 billion market size is the largest market in the region while Qatar has recorded the highest growth in recent past.

Customers are increasingly becoming value conscious: They are also able to compare the offerings of different service providers before choosing the best deal.

Accelerated construction pipeline depicts growing industry demand: The GCC construction pipeline looks very robust with the projects due for completion in 2014 valued at US$ 8.6 billion compared to US$ 3.7 billion in 2013.

Spa and wellness themes gaining popularity: UAE is set to become the number one spa destination in the GCC while Qatar is also expected to witness strong growth. The improving healthcare infrastructure along with the region’s reputation as a tourism hub is leading the development of medical tourism within GCC.

Sharia compliant brands boost lifestyle tourism: Many hospitality firms are planning to offer products and services targeted at meeting the needs of observant Muslims interested in exploring the world.

Shift towards budget travel: The growth of budget airlines, tight tourist budgets, shorter stays and the rise of the ‘no frills’ customers have shifted the focus to the budget segment.

More international chains looking to start operations in the GCC: Many international hotels are entering as well as expanding in the region either independently or through collaboration with local hotels.

Growing demand for serviced apartments: Demand for serviced apartments is on the rise as this is an attractive option for visitors from the region who tend to travel with larger families. Business travelers looking for longer term stay also tend to prefer serviced apartments.

Continuous Innovation: Importance of the ‘Digital Native’ segment of customers is growing with mobile technology, applications and tablets replacing menu cards and centralised automated hotel operations taking over conventional means. Hotels are also tapping user generated feedback on a real time basis through social media presence to improve their products and services as per visitors’ feedback.

Challenges and the way forward

Although the GCC Hospitality sector is on a growth trajectory, there is an oversupply concern, given the fact that some of the GCC countries are adding huge hotel capacities in the run up to the planned mega events. Sustaining demand could be a challenge, especially once these events are concluded. Shortage of skilled work force is another major challenge for the hospitality industry. Furthermore, increase in number of new properties is posing a threat to the older ones and operators are spending on improving older properties to remain competitive.

Despite the recent reforms initiatives taken by the regional governments, many challenges remain for the foreign companies looking to set up business in GCC. These include investor protection concerns, punitive bankruptcy laws, continued ownership restrictions for certain sectors and thrust towards localisation of labor force. Also, the disclosure norms are not at par with those in the developed countries, making it difficult for some of the international companies to get into collaborations and joint ventures with local players.

Despite these challenges, the GCC hospitality industry’s outlook remains promising. Regional governments as well as sector participants are taking initiatives to address the challenges faced by the industry and to improve its prospects.

For more details please click here to access the GCC Hospitality Industry online.

Back

Back