Alpen Capital’s latest education industry report projects the total number of students in the GCC to increase by 1.1 million and reach 14.2 million by 2027. During the forecast period, K-12 enrolments in the region are expected to grow at a CAGR of 1.5% to reach 11.7 million by 2027.

UAE-based investment banking advisory firm, Alpen Capital, launched its latest GCC Education Industry report on Wednesday, August 2nd which features forecasts on the sector, recent analysis on trends, growth drivers and challenges facing the segment. It also profiles some of the renowned education companies in the region.

The report was launched over a webinar followed by a panel discussion featuring Krishna Dhanak, Managing Director, Alpen Capital; Alan Williamson, CEO, Taaleem; Dr. Munirah M.Alaboudi, Education Segment Director, Ministry of Investment of Saudi Arabia and Ivor McGettigan, Partner, Al Tamimi & Company. Hameed Noor Mohamed, Managing Director, Alpen Capital moderated the discussion.

The GCC education sector has advanced significantly over the past few years with governments’ focus on diversifying their economies and enhancing the quality of education to bring it at par with international standards. It has also witnessed significant technological investments, especially post COVID to establish avenues of uninterrupted learning. This accompanied by rising population, high disposable incomes and increasing private sector participation is expected to drive enrolments in the region.”, says Sameena Ahmad, Managing Director, Alpen Capital (ME) Limited.

She further adds that, “Focus on creating blended learning platforms has created multiple opportunities for EdTech service providers to expand their presence which has led to a rise in investments in the sector. However, eroding profit margins, shortage of skilled staff and intensifying competition are some of the challenges impeding growth of the sector.”

“Student enrolments across the region witnessed an increase of more than half a million over the past five years. Apart from growing school age population, this was led by factors such as influx of private school operators, favourable policies/ guidelines and focus on technology-driven education, which are also expected to continue playing a crucial role in future growth.

With normalization of valuations post COVID-19, the GCC education sector largely witnessed intra-regional transactions as larger operators sought tuck-in acquisitions to broaden their geographic reach and increase their market share. Going forward, acquiring stakes in EdTech platforms is anticipated to gain interest. Additionally, the rise in demand for affordable schooling and the need to build digital infrastructure to remain competitive, will present interesting opportunities across the region”, says Krishna Dhanak, Managing Director, Alpen Capital (ME) Limited.

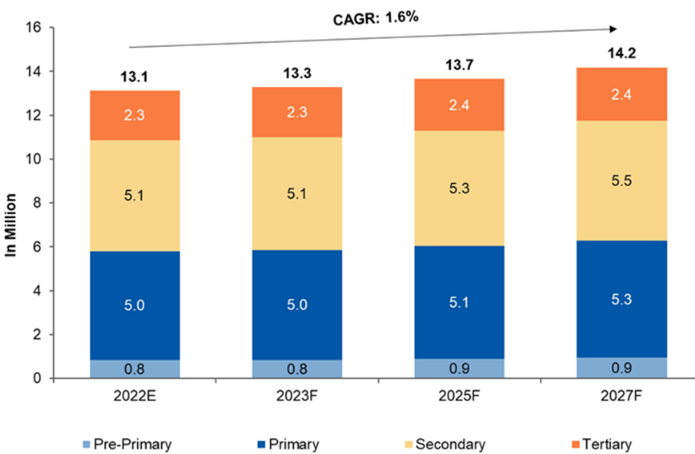

According to Alpen Capital, the total number of students in the GCC education sector is projected to increase by 1.1 million to reach 14.2 million by 2027, growing at a CAGR of 1.6% from an estimated 13.1 million in 2022. Growing school age population, high per capita income, sizeable budgetary allocations and favourable government initiatives are expected to drive future growth of the sector. Moreover, the growing adoption of technology and ramping up of investments in digitally aided platforms will help boost the quality of education across the GCC

Between 2022 – 2027, the pre-primary and tertiary segments are expected to grow at a faster rate than the other segments. The pre-primary segment is expected to grow at a CAGR of 2.2% aided by the growing awareness of early-age education and the tertiary segment is expected to grow at a CAGR of 1.7% owing to increasing demand and an enabling environment. The primary and secondary segments, which constitute the majority share of enrolments are expected to witness a growth of 1.5% CAGR.

The number of students in private schools is projected to grow at a CAGR of 1.7%, whereas enrolments at public schools is likely to increase at a marginally slower pace, recording a CAGR of 1.5% between 2022 and 2027.

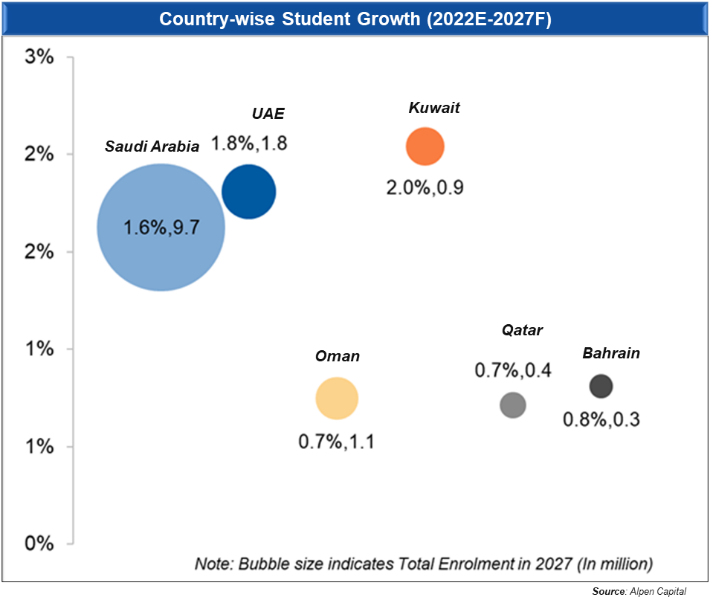

Growth rates among the GCC nations varies widely owing to country-specific population projections, cost of education, government support and maturity of the sector, among other factors. Saudi Arabia is expected to remain the largest education market in the GCC growing at a CAGR of 1.6%. In terms of annualized growth, the number of students in Kuwait and UAE are projected to grow at a faster rate than the other member nations between 2022 and 2027

The demand for schools in the GCC is likely to increase at a CAGR of 0.7% translating to an addition of an estimated 1,127 schools by 2027 to reach 35,208. While the demand for public schools is expected to increase at a CAGR of 0.4% between 2022 and 2027, the number of private schools is anticipated to grow at a faster rate of 1.5%.

The report states that the projected economic growth of the region will allow the GCC governments to increase their budgets towards the education sector and allocate substantial funds towards infrastructure development programs. In addition to the organic growth in population, rise in the number of expatriates and high net-worth individuals across the GCC is likely to boost the region’s private education sector as they seek for international schools offering high quality education, at par with global standards. Furthermore, introduction of new visa categories for exceptional talents, scientists, and outstanding students and graduates will encourage them to continue to live and work in the country, thus building a skilled workforce that can contribute to economic development.

However, factors such as high cost of construction, inflationary pressure, long gestation period, rising competition, and lack of subsidies are increasing cost pressures and eroding profit margins for private operators in the education sector. The sector also continues to face a shortage of skilled teachers which is expected to intensify given a healthy pipeline of new international schools being set up in the region.

The report also highlights that regional governments, in collaboration with public and private participants, are playing a critical role in transforming traditional learning methods into blended digital capabilities to facilitate learning. Consequently, EdTech platforms have grown exponentially in recent years enabling schools to provide higher engagement and flexibility. Inequality within the private school system due to the fee structures and corresponding levels of quality is supporting the rise in demand for affordable schooling in the GCC. The region is also witnessing the establishment of a number of foreign colleges and universities, particularly those from the UK and the US to meet the rising demand.

The GCC countries are making considerable investment towards the education sector in order to curate an ecosystem that meets international standards. Consequently, the sector has undergone significant transformation in recent years, particularly with the integration of technology. Building a strong technology infrastructure will not only complement the overall development of the GCC education ecosystem, but also further open the sector for higher growth and investment opportunities.

Please click here to access Alpen Capital’s latest report on GCC Education Industry.

Back

Back