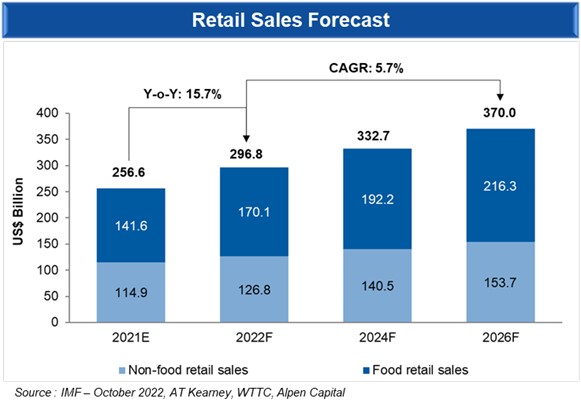

According to Alpen Capital, the GCC retail industry sales are forecasted to grow at a pace of 5.7% CAGR between 2022 and 2026 to reach US$ 370.0 billion.

The industry is expected to see renewed growth largely driven by the anticipated rebound in economic activity, increase in population, upcoming mega events and rising adoption of digital technologies. Regional governments are also making significant investments to enhance the leisure and entertainment sector while also enhancing the tourism and hospitality infrastructure as it witnesses influx of tourists post the pandemic.

Non-food retail sales are forecasted to grow at a CAGR of 6.2% between 2022 and 2026 while food retail sales are anticipated to increase at an annualized rate of 4.9% during the period.

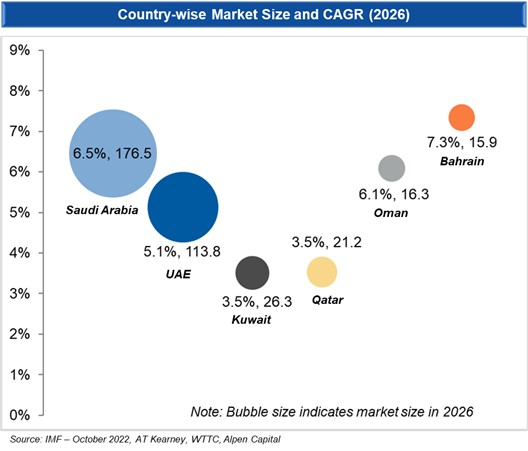

Retail sales in the GCC nations are projected to grow in the range of 3.5% and 7.3% CAGR between 2022 and 2026. Saudi Arabia and UAE continue to lead the retail sales regionally, cumulatively accounting for 78.5% of the total sales by 2026. This is largely due to their large and diverse population base, liberalization of policies and a growing appetite for unique shopping experiences. Retail sales in the Kingdom and UAE are forecasted to grow at a CAGR of 6.5% and 5.1%, respectively, between 2022 and 2026.

Qatar, on the other hand, is expected to record the highest growth in the region during 2022 with retail sales estimated to rise by 36.0% y-o-y to reach US$ 18.5 billion owing to the influx of tourists for the FIFA World Cup 2022. However, growth is expected to normalize at a CAGR of 3.5% post completion of the World Cup.

Bahrain, Oman and Kuwait are expected to grow at a CAGR of 7.3%, 6.1% and 3.5%, respectively during the forecast period.

The report estimates that duty free sales at the airports in the GCC (Dubai, Abu Dhabi, Qatar and Bahrain) are expected to grow by 65.5% y-o-y to reach US$ 2.2 billion in 2022 and further projected to reach US$ 3.0 billion by 2026, implying a CAGR of 8.4%.

At 80% completion of projected additions to the retail space, 4.5 million sq m. of retail space is likely to come up in the GCC between 20221 and 2026, taking the total organized retail GLA in the region to 23.0 million sq m. This is a modest growth scenario, wherein organized retail GLA is anticipated to grow at a CAGR of 4.5% during the period.

The report highlights that business confidence in the region is bouncing back with the reopening of borders, easing of travel restrictions and rise in hydrocarbon revenues. GCC is fast becoming a global center for business, entertainment and sporting events with a slew of events slated to take place boosting tourist arrivals. Moreover, rising population, with a high concentration of expatriates and HNWIs, remains one of the primary factors for driving growth of the GCC retail industry. Additionally, the recently signed FTAs with India and Israel will not only increase the range of foreign food and non-food products within the domestic retail outlets but also expand the establishment of international brands in the region.

However, the report also notes that lower revenues due to sharp correction in oil prices coupled with global inflation has put the industry under increased pressure. It has pressed retailers to adopt aggressive promotional campaigns by offering discounts to further drive revenues. Furthermore, rising number of international brands operating in the region have intensified competition within the retail market.

The COVID-19 health crisis has ushered in a new trend in the digital retail space with consumers shifting to online channels while regional players swiftly responding to the surge in demand. Digitization is likely to help operators streamline procedures, reduce costs, lower staff workloads, increase revenue generation potential, and improve overall level of customer experience. Considering the market has become more mature and competitive, players are looking for scale and focusing on developing new business models while also re-conceptualizing their pricing strategies.

To download the report, please click here.

Back

Back