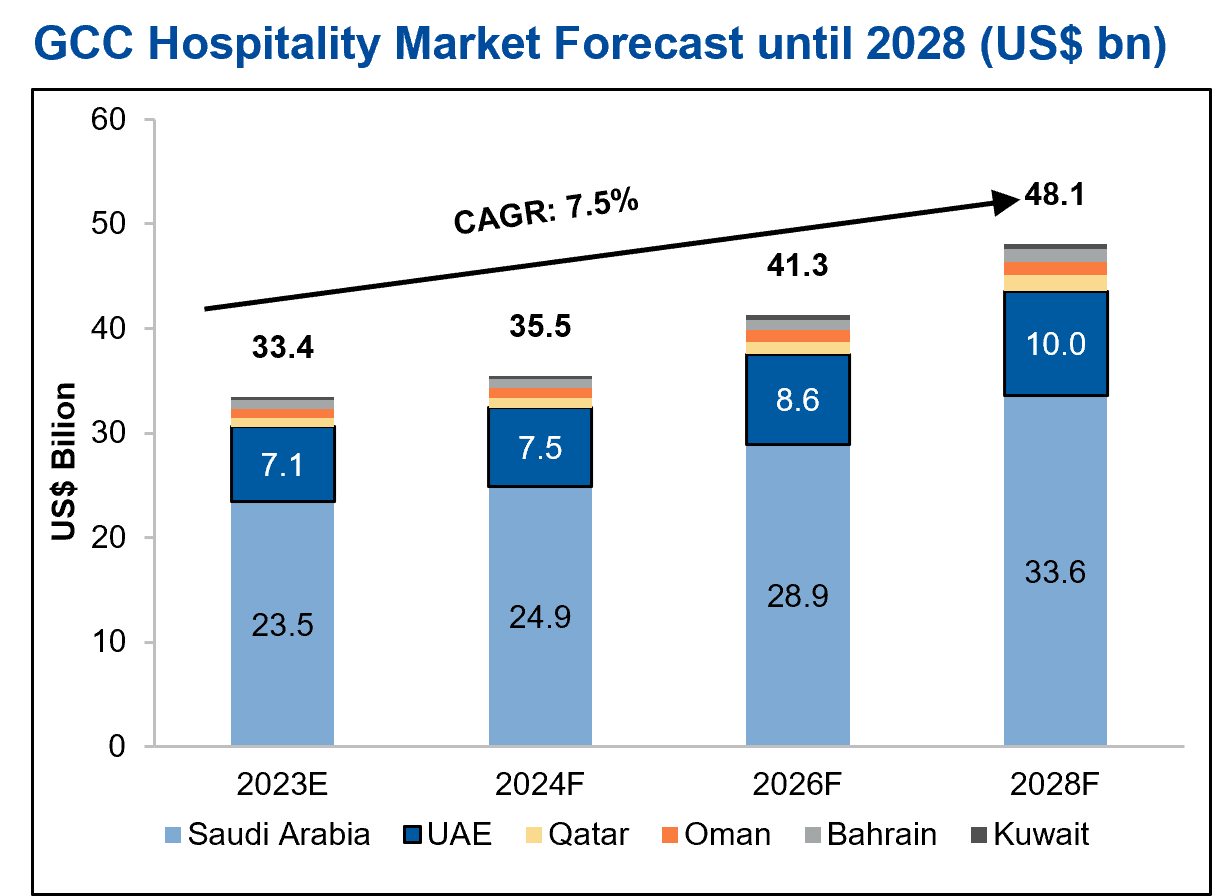

According to Alpen Capital, the GCC hospitality sector revenue is expected to grow at a CAGR of 7.5% from 2023 to 2028, reaching approximately US$ 48.1 billion by 2028. This robust growth is fueled by the unified efforts of the GCC countries in prioritizing hospitality as a key element of their long-term diversification strategies. Furthermore, steady economic growth, increasing tourist arrivals and a multitude of mega MICE and sporting events to be hosted in the region will support the projected growth.

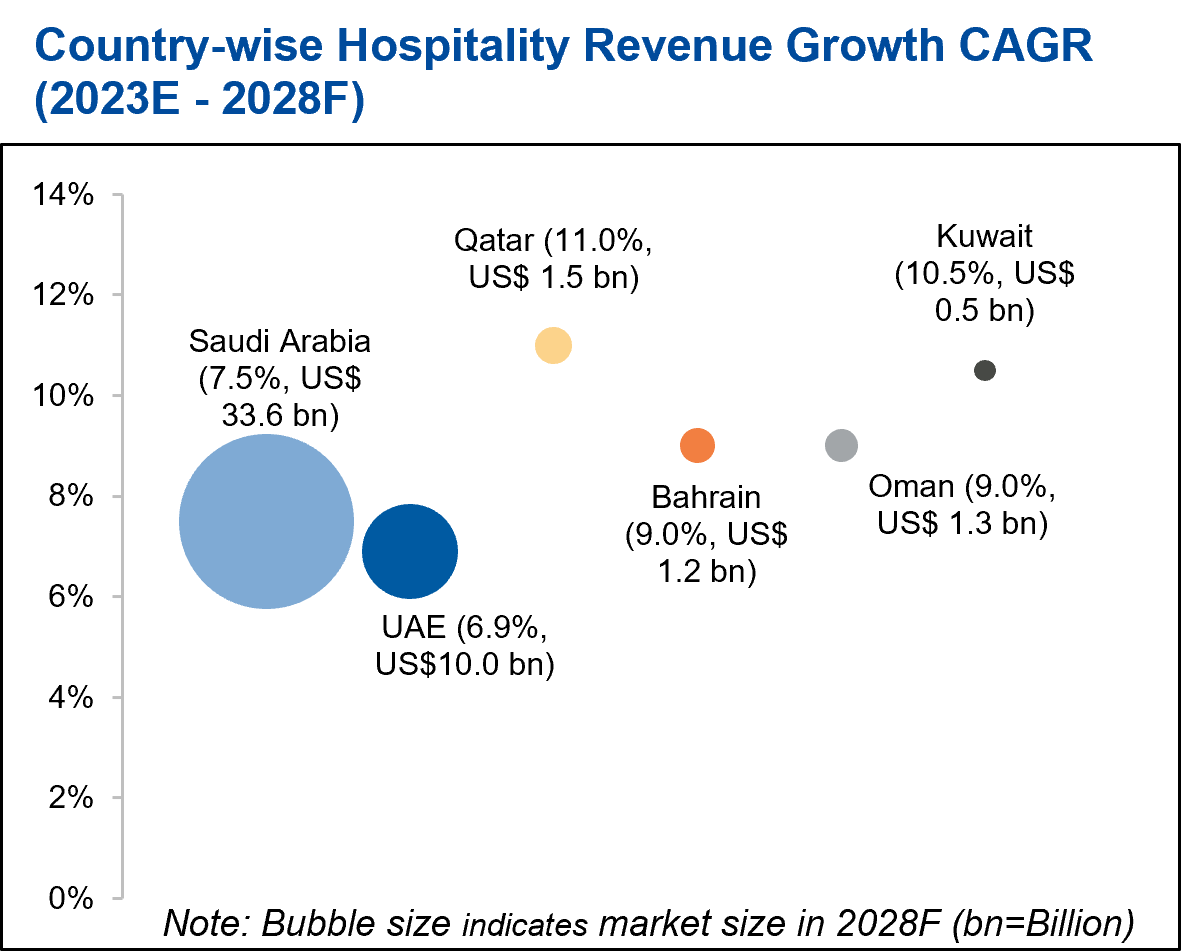

The growth in the hospitality sector revenue of individual GCC countries is expected to range from a CAGR of 6.9% to 11.0% between 2023 and 2028. Saudi Arabia is projected to grow in line with the GCC average of 7.5%, supported by numerous government-led initiatives as part of its Vision 2030, whereas the UAE is expected to grow at a CAGR of 6.9%, backed by the government's focus on modernizing infrastructure and easing tourist visa rules. Smaller markets are expected to witness high growth rates during the forecast period, with Qatar at 11.0%, Kuwait at 10.5% and, Oman and Bahrain at 9.0% CAGR.

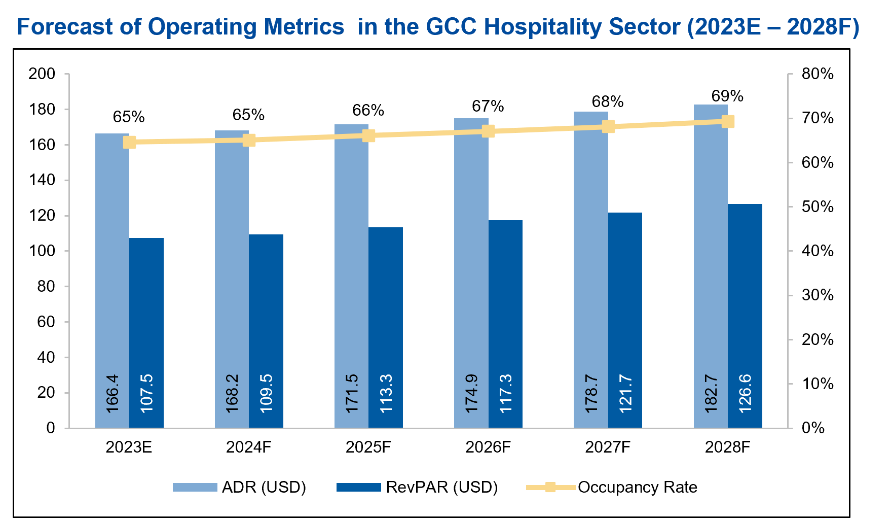

Given the projected growth of the GCC’s hospitality sector, its three key operating metrics - Occupancy Rate, Average Daily Rate (ADR) and Revenue Per Available Room (RevPAR) - are expected to improve over the next five years. The occupancy rate in the GCC is estimated to rise consistently due to increasing tourist arrivals. It is forecasted to grow from 64.6% in 2023 to 69.3% in 2028. ADR is expected to increase at a CAGR of 1.9% during the same period, from USD$ 166.4 to US$ 182.7, whereas RevPAR is forecasted to grow at a CAGR of 3.3% from US$ 107.5 in 2023 to US$ 126.6 in 2028

The GCC is solidifying its global tourism footprint through successful hosting of major MICE, cultural and sporting events. Anticipated to attract millions of tourists, these events are poised to bolster the growth of the hospitality industry. Moreover, the region has implemented several liberalised measures to further boost tourist inflow, including initiatives such as unified GCC visas, Dubai's five-year multiple-entry visa and Saudi Arabia's instant e-visa options. Regional and religious tourism are pivotal to the GCC’s economic diversification strategy, prompting implementation of unique models of engagement to enhance activity in these areas. Concurrently, the GCC continues to invest in its transport infrastructure by expanding airport capacity, constructing new airports, and building a rail network for better regional and international connectivity. These efforts are expected to support tourism activity and increase the demand for hospitality related services.

As per the report, the hospitality sector is facing challenges stemming from global economic uncertainties and geopolitical conflicts. Concerns about inflation and monetary policies may dampen consumer confidence, leading to reduced discretionary spending on international travel. Furthermore, a shortage of skilled workers presents a significant hurdle to the sector's growth trajectory, hindering its ability to recruit and retain trained professionals for various roles.

The GCC hospitality sector has undergone a significant shift towards digitalization, driven by technological advancements and evolving consumer preferences. Operators are leveraging cutting-edge technologies like artificial intelligence (AI), machine learning (ML), cloud platforms, and mobile apps to personalize experiences and enhance customer engagement. In tandem, the region is embracing sustainable tourism by adopting eco-friendly practices and conservation initiatives, to meet the growing demand for responsible travel. Moreover, there is a rapid growth in cultural, health, and wellness tourism, reflecting shifting consumer preferences and a commitment to environmental conservation.

Alpen Capital anticipates that the industry will strategically enhance visitor experiences and stimulate demand through innovation and consolidation. This proactive approach positions the GCC hospitality sector to navigate uncertainties and uphold its prominent status in the global tourism market.

Back

Back