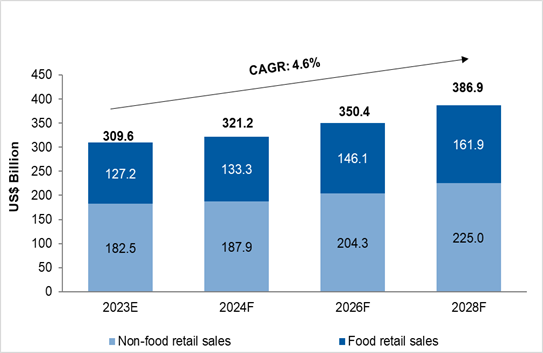

According to Alpen Capital, retail sales in the GCC are projected to grow at a CAGR of 4.6% to reach US$ 386.9 billion in 2028 from US$ 309.6 billion in 2023. This growth is expected to be supported by an increase in population, rise in per capita income and boost in tourism activities. E-commerce is expected to continue to play a critical role as several new players are gaining prominence, and there remains a scope for niche platforms to adopt innovative business models to make the GCC retail landscape more competitive.

Non-food retail sales are anticipated to grow at a CAGR of 4.3%, while food retail sales are expected to rise at a pace of 5.0% CAGR between 2023 and 2028 in the GCC

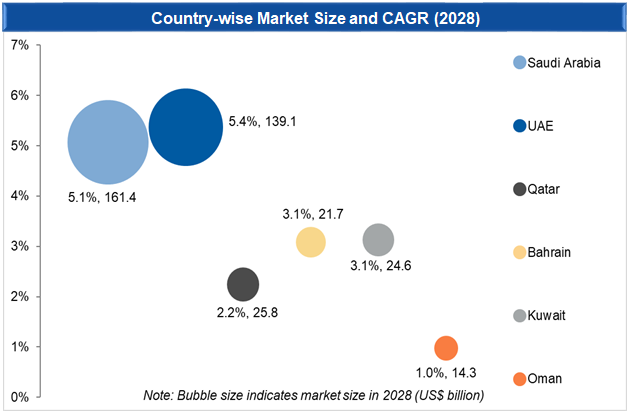

Retail sales in the GCC nations are projected to grow in the range of 1.0% and 5.4% CAGR between 2023 and 2028. Saudi Arabia and the UAE are projected to grow at a CAGR of 5.1% and 5.4% to reach US$ 161.4 billion and US$ 139.1 billion, respectively. Growth will be driven by its diverse and expanding population base, and vibrant infrastructure that makes them top international shopping destinations. These two nations are expected to cumulatively account for 77.7% of the total GCC retail sales by 2028.

Retail sales in Kuwait and Bahrain are projected to witness a CAGR of 3.1% each between 2023 to 2028, whereas Qatar and Oman are expected to grow at a CAGR of 2.2% and 1.0%, respectively.

Duty free sales at the airports in the GCC (Dubai, Abu Dhabi, Qatar and Bahrain) are expected to reach US$ 4.7 billion in 2028, growing at a CAGR of 9.3% between 2023 and 2028. This growth can be attributed to the anticipated rise in passenger traffic, largely driven by government initiatives to promote tourism.

At 80% completion of projected additions, 3.9 million sq. m. of retail space is likely to come up in the GCC between 2023 and 2028, taking the total organized retail GLA to 24.3 million sq. m. This is a modest growth scenario, wherein organized retail GLA is anticipated to grow at a CAGR of 2.9% during the period.

As per the report, rising population, with a high concentration of expatriates and HNWIs, remains one of the primary factors for driving growth of the GCC retail industry. Anticipated pick up in the economic activity and improvement in per capita income is expected to further advance the appetite for global brands and luxury items. Amid expanding infrastructure developments, the GCC economies are establishing themselves as a hub for global business, entertainment, and sporting events. At the same time, religious and cultural tourism has been a key driver of growth within the GCC, attracting a large portion of tourist arrivals, especially during pilgrimages and other festivals.

Despite the diversification efforts of the GCC nations coupled with strong growth momentum in the non-oil sector, vulnerability in hydrocarbon revenues due to oil production cuts, coupled with rising geopolitical concerns and global macro-economic headwinds might put the industry under pressure. The region is also sensitive to supply-side shocks, which could lead to inflationary pressures on the economies and affect spending power of the consumers. Furthermore, intensifying competition is causing operators to adopt aggressive promotional strategies that are impacting profit margins.

GCC retailers continue to adopt omni-channel business models to remain competitive and meet the rising demand of consumers for seamless and integrated shopping experiences. Operators are utilising technological advancements and data analytics to streamline procedures, reduce costs, increase revenue and enhance customer experience. Furthermore, trends like Buy Now Pay later, enabled by Fintech providers, are experiencing significant growth as consumers become more price conscious.

Going forward, the need for businesses to stay competitive amid proliferation of e-commerce and online channels is likely to enhance the retail M&A landscape in the GCC. Furthermore, long-term fundamentals will continue to drive growth of the retail sector as it continues to remain a key pillar for the region’s economic development.

Back

Back