Download Report

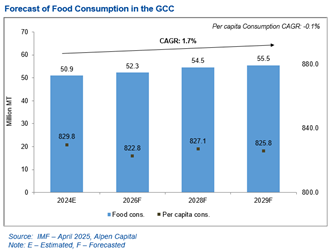

According to Alpen Capital, food consumption in the GCC is projected to grow at a CAGR of 1.7% to reach 55.5 million MT by 2029 from an estimated 50.9 million MT in 2024. This growth is expected to be driven by an increasing population, high per capita incomes and rising tourism. Additionally, the heavy investments being made by the regional governments to strengthen food security is likely to support a sustainable supply of food items to meet the rising demand.

The report states that the growth across different food categories is expected to range between 1.4% and 1.9% over 2024 to 2029. The cereals food category is projected to secure the highest CAGR at 1.9%, followed by the ‘others’ category, consisting of fish, eggs, pulses, honey, potato, oil and fats, which is expected to witness at a CAGR of 1.8%. Other major food categories such as vegetables, milk/dairy, fruits and meat are estimated to grow at similar paces due to evolving dietary preferences and high spending power.

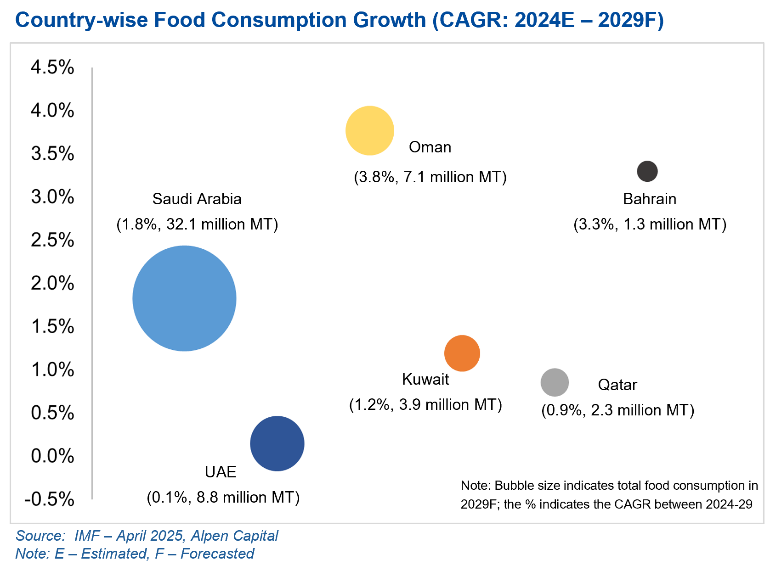

The country-wise food consumption share in the GCC is projected to change marginally through 2029. Saudi Arabia and the UAE are expected to remain the largest food-consuming nations, and their combined share of total GCC food consumption is forecasted to reach 73.8% by 2029. Oman is set to witness the highest CAGR at 3.8%, followed by Bahrain with a CAGR of 3.3% during the forecast period. The remaining GCC countries are expected to register growth rates between 0.1% and 1.8%.

The GCC’s economy underpins steady growth in food consumption, powered by oil wealth, diversification efforts and a surge in tourism. The region’s strong focus on broadening its economic base, alongside ongoing structural reforms and increased private sector engagement to enhance competitiveness, is expected to sustain long-term growth. Additionally, the expanding population base naturally increases overall food demand, with working age professionals holding immense influence over food consumption trends, retail formats, and technology adoption in the food ecosystem. Governments are actively championing agritech and innovation as strategic tools to enhance food security, reduce import dependence, and promote sustainable food consumption. They also continue to intensify their investments in overseas agricultural lands to diversify and secure supply chains.

Since the GCC remains heavily reliant on food imports, it is exposed to supply chain disruptions, geopolitical risks, and price volatility. Moreover, limited arable land, scarce water resources, and harsh climatic conditions constrain domestic production, making self-sufficiency an ongoing challenge. Although strategic initiatives and technological interventions are underway, rising population and escalating food demand continue to intensify pressure on the food system. Food waste further challenges the region’s food security and sustainability goals.

The report highlights that the GCC food market is being shaped by health-conscious consumption, driven by rising rates of obesity, diabetes, and lifestyle-related diseases. Consumers are increasingly seeking low-sugar, high-protein, organic, and plant-based options, prompting food manufacturers to reformulate products, expand health-focused portfolios, as well as adopt advanced technologies and sustainable practices. Consumer preferences are also being driven by a strong focus on convenience, cost and value-based choices, which continues to support the expansion of online food delivery, quick-commerce grocery apps, and cloud kitchens.

Governments and operators are swiftly responding to an ecosystem characterized by rising health consciousness, growth of digital ordering, and demand for sustainable, high-quality products. To stay ahead, they are acquiring capabilities and assets that can fast-track innovation and accelerate market penetration. Going forward, consolidation is expected to continue, especially in agritech, digital F&B, and last-mile delivery, where technology integration and supply chain resilience are becoming critical differentiators.

Back

Back